Tech Growth Stocks: Exploring Investment Opportunities Amidst Market Declines

Written on

Chapter 1: Current Market Overview

The recent downturn in the market has notably impacted technology and growth stocks. For instance, the QQQ ETF, which tracks the Nasdaq-100 Index, has seen a decline of over 17% since the beginning of the year, recently dropping below the previous support level of 352.

Investor sentiment is decidedly pessimistic right now. If you hold any tech or growth stocks, you might be experiencing significant discomfort due to the ongoing market pullback. However, market declines can also present chances to acquire certain stocks at significantly reduced prices.

This article will delve into the key metrics to evaluate when selecting fundamentally robust tech growth companies for investment, as well as highlight a few firms that have caught my attention.

Key Metrics to Evaluate

- Positive Net Income with Growing Revenue

- Improving Gross and Operating Margins

Why prioritize positive net income? The logic here is straightforward: we should only invest in companies that are already profitable. Strong sales growth is one thing, but a combination of rising sales and profitability is critical.

As the Federal Reserve begins to tighten its monetary policy and increase interest rates, tech growth firms are likely to face challenges. Consequently, it becomes crucial to be discerning in selecting companies for our investment portfolios.

Additionally, assessing margin improvements is vital. We want to ensure these companies can sustain or even enhance their earnings amidst the current inflationary climate.

Case Study #1

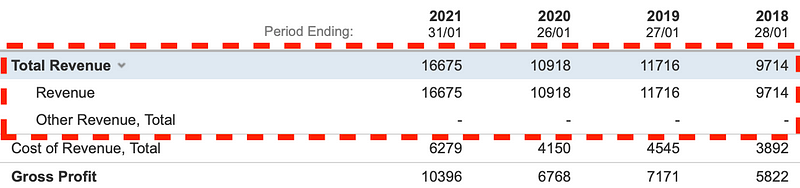

The following screenshot illustrates an upward trajectory in revenue over the last three years. Notably, revenue growth from 2020 to 2021 exceeded 50%, indicating a rapidly growing technology firm.

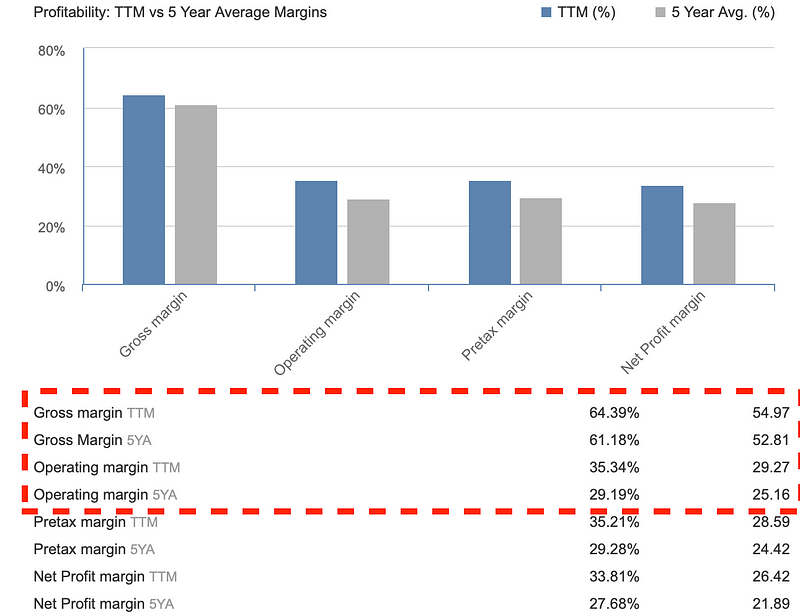

Data sourced from Investing.com shows that both the trailing twelve months (TTM) gross and operating margins are robust, surpassing industry averages.

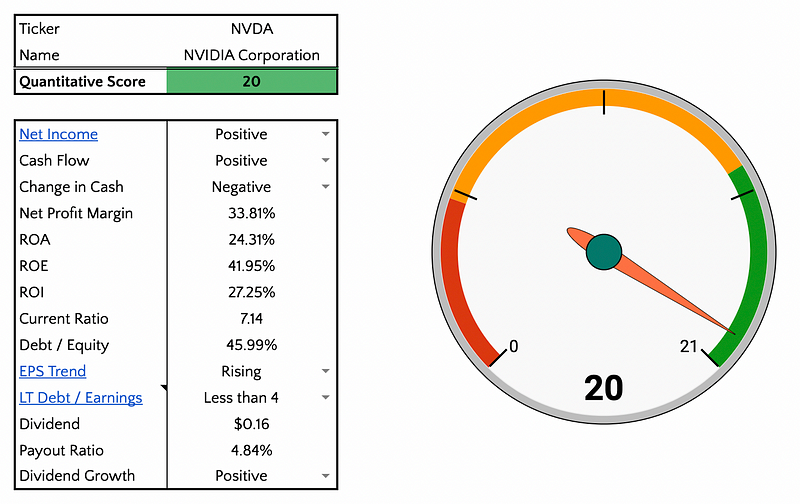

Next, let’s examine the fundamental performance of Nvidia Corporation (NVDA). While these metrics are promising, they don’t solely determine Nvidia's strength as a company. A comprehensive model helps assess a company’s fundamental score.

Here’s Nvidia’s fundamental score:

This analysis confirms Nvidia as a company with solid fundamentals, making it a noteworthy candidate for investment during this period.

However, since reaching its peak in November 2021, NVDA’s price has plummeted nearly 40%. From a technical analysis perspective, this trend signals caution against purchasing Nvidia at the moment. As the saying goes, "Don't attempt to catch a falling knife."

On one hand, fundamental analysts might argue, "Nvidia is now 40% off! It's a fantastic opportunity to buy more shares!" On the other hand, technical analysts might respond, "It's in a downtrend; let's consider selling."

What’s your stance? Is it a buying opportunity or a time to sell? Personally, I'm keen on investing in Nvidia, but I would certainly leverage technical analysis to strategically time my entry.

For our eSmart Mastermind community, we will delve deeper into this thematic investment in our upcoming discussions.

Companies on My Radar

- Nvidia Corporation (previously discussed)

- Onto Innovation

- Zoom Video Communications

This list is not exhaustive; more companies fit this tech growth investment theme. For this article, I have highlighted these three firms for your consideration.

Chapter 2: Investment Insights

The first video titled "Top 7 Stocks to BUY NOW (High Growth Stocks)" provides an overview of promising growth stocks currently available in the market, offering insights into potential investment opportunities during this downturn.

The second video, "Do NOT Buy THESE Tech Stocks Until This Happens," discusses critical indicators to watch for before making tech stock investments, ensuring informed decision-making in uncertain times.