Yen Liow’s Insights on Navigating Investment Strategies

Written on

Chapter 1: Understanding Business Stages

Yen Liow’s insightful presentation offers valuable takeaways that I believe everyone should consider. He categorizes the lifecycle of companies into three distinct phases: Proof of Concept (POC), Replication, and Maturation. The POC phase is characterized by the validation of a business model, which typically involves venture-type investing. Once a company has secured its market position, it enters the Replication stage, where it expands its monopolistic presence, often requiring growth equity.

While POCs are generally associated with micro-cap firms or small startups, there are notable large public companies still operating within this phase. Conversely, companies in the Replication phase are not solely large-cap entities; many small-cap firms may also be scaling their operations. This phase can extend over a decade for some businesses, emphasizing the need for investors to align their interests with the companies they choose to follow or invest in. The critical question to consider is: What type of game are you willing to play?

Chapter 2: Game Selection and Personal Strategy

Choosing your investment strategy is influenced by various factors, including your unique skill set, investment horizon, available capital, liquidity constraints, and psychological readiness. This process requires deep self-reflection to determine the type of investor you aspire to be.

Large companies naturally attract more attention, leading to inefficiencies in larger markets that can arise from temporal issues, while smaller markets face structural inefficiencies. Many funds shy away from low-volume companies, particularly those in the small-cap sector. Recognizing your advantages as an independent investor can provide an edge in these markets.

For instance, having limited capital enables me to establish sizable positions quickly, a flexibility that larger funds often lack. My independent status allows me to navigate small companies effectively; however, I must be diligent in identifying those rare finds in the Replication phase, as many in this sector are still in the POC stage.

Liow also emphasizes strategies aimed at achieving substantial returns, such as 100x or 10x investments. To attain 100-baggers, investors typically need to engage with POCs, as entry at a low price is essential. On the other hand, opportunities for 10x returns can emerge during the Replication stage.

Consider a portfolio of 50 stocks, each representing a 2% investment using a POC strategy. Companies that deliver 100x returns are exceedingly rare; while many believe they have discovered the next Amazon, true outliers are hard to find. A more pragmatic approach might involve a 20% position aimed at achieving a 10x return. The choice of game and the realities of your circumstances are critical in this decision-making process.

Chapter 3: Evaluating Moats and Competitive Advantages

Liow identifies three indicators that suggest a business possesses a competitive moat:

- High competitive win rates (i.e., advantageous conditions).

- Consistent gross margins over time, indicating pricing power.

- Strong return on incremental invested capital (ROIIC), showcasing the ability to deploy capital effectively.

If these factors persist over time, they may indicate a robust business with the potential to achieve oligopoly or monopoly status, although they do not necessarily reveal the underlying causes of such advantages.

Section 3.2: The Role of Management

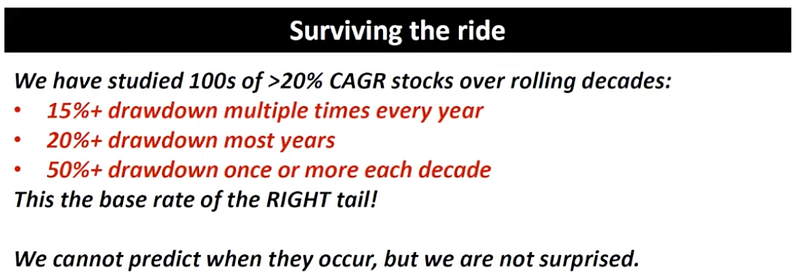

Investing in businesses that aim for exceptional results requires companies to defy typical performance metrics. The presence of elite management teams can significantly influence outcomes, as strong leaders often navigate challenges effectively. It’s essential to invest in individuals you respect, trust, and admire, as the journey through volatility will test your resolve.

Great businesses that achieve proof of concept must rely on capable management teams to scale successfully in the Replication phase.

Section 3.3: Assessing Price for Investment

The price you pay for an investment can offer insights into your potential returns. For those investing in highly predictable businesses, price volatility can serve as an advantage.