Maximize Your Earnings: A Guide to Staking UST for 20% Interest

Written on

Chapter 1: Introduction to Staking

Staking is a relatively new concept that piqued my interest. I first learned about it while exploring Ethereum on Coinbase, where users could earn approximately 7% interest. Recently, I stumbled upon several articles discussing the staking of stablecoins, which led me to Max Petrusenko’s Medium article on the Anchor Protocol, highlighting its impressive 20% APY on UST. Intrigued, I decided to give it a shot.

The initial step involves purchasing UST, a crypto stablecoin. I opted to acquire mine using a credit card through the Kado Ramp crypto exchange.

Following that, you need to transfer or link your UST stablecoin to a Terra Station wallet. This required me to set up a Terra Station account and create a crypto wallet on their platform.

Once I had my UST in the Terra Wallet, the next step was to activate the “Earn” feature using the Anchor Protocol.

This outlines the "what" I needed to accomplish. The "why" was to deepen my understanding of cryptocurrency and staking while aiming for a 20% return on my investment. The "how" necessitates a closer examination.

These steps, accompanied by visuals and commentary, will guide you through the process of purchasing UST stablecoin and staking it for interest.

Section 1.1: Purchasing UST

To buy UST, you need to visit a crypto exchange of your choice and complete the purchase. Ensure you have a wallet ready to store your investment. After acquiring the UST, you should set it to “Earn” instead of merely holding it.

Subsection 1.1.1: Setting Up Your Terra Station Account

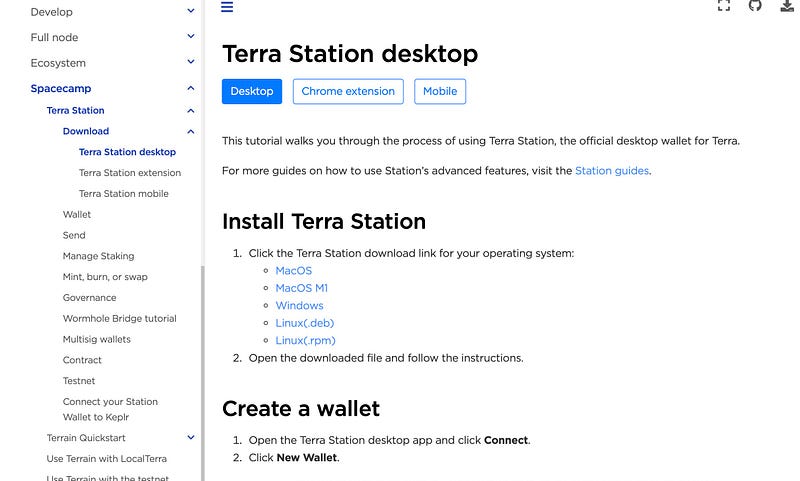

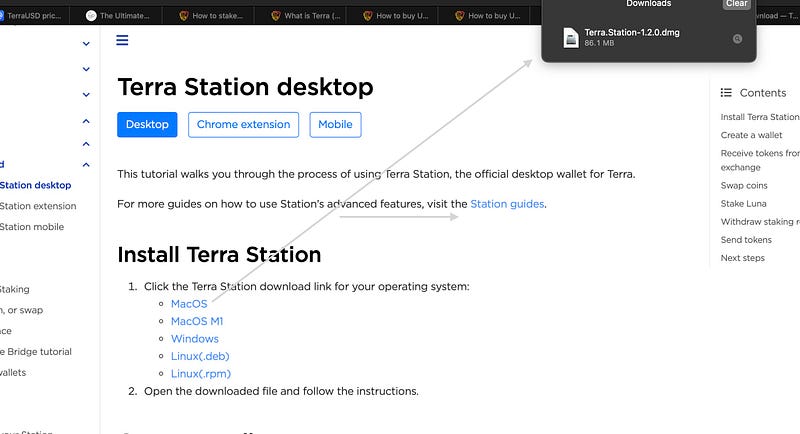

To begin, navigate to the Terra Station documentation site. Here, you can download their desktop application and proceed with the setup. You may also access their Dashboard website.

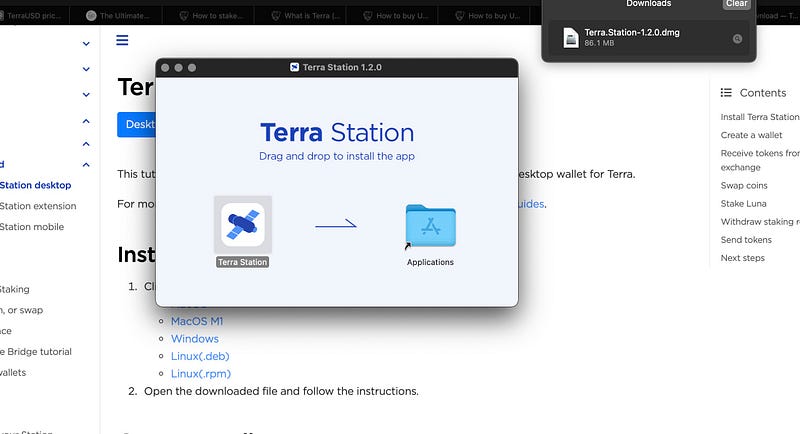

Once the application is downloaded, install it into your Applications folder.

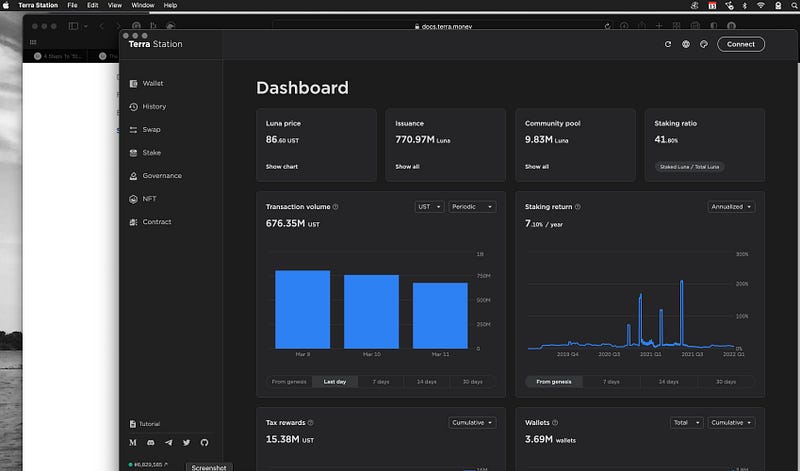

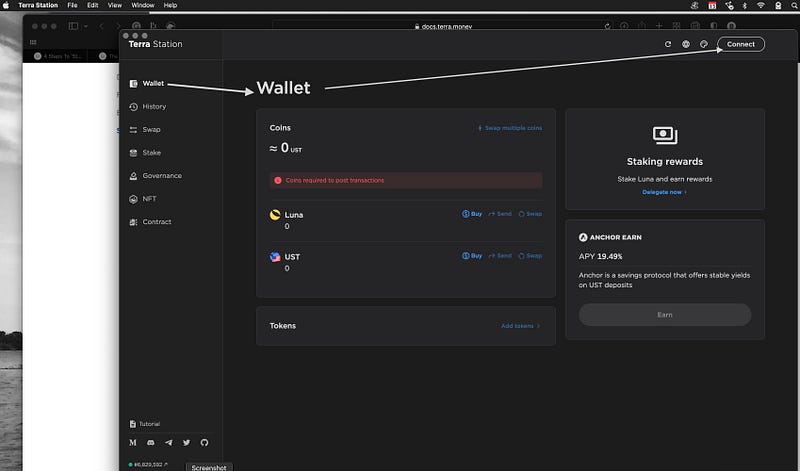

Open the application to access the Terra Station Dashboard.

To utilize the Terra Station site and purchase stablecoin, you need a wallet.

Section 1.2: Creating a Wallet

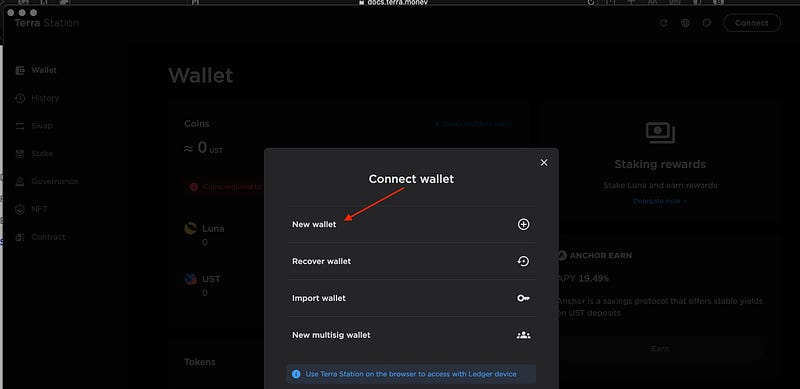

Creating a wallet on Terra Station is the first step in purchasing the stablecoin. From the Dashboard, select “Wallet.” If you already have a wallet, you can connect it to the Dashboard; otherwise, proceed to create a new one.

When you choose “Connect,” the option to create a new wallet will appear.

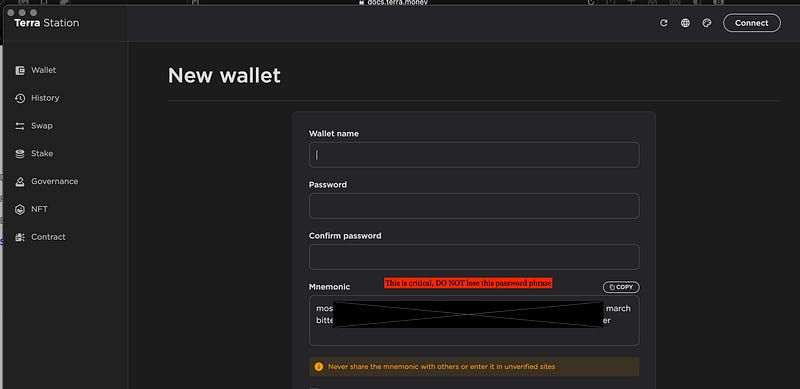

Selecting “New wallet” prompts a pop-up where you can name and secure your wallet with a password. Be sure to keep a hard copy of the unique mnemonic generated, as losing it means losing access to your cryptocurrency.

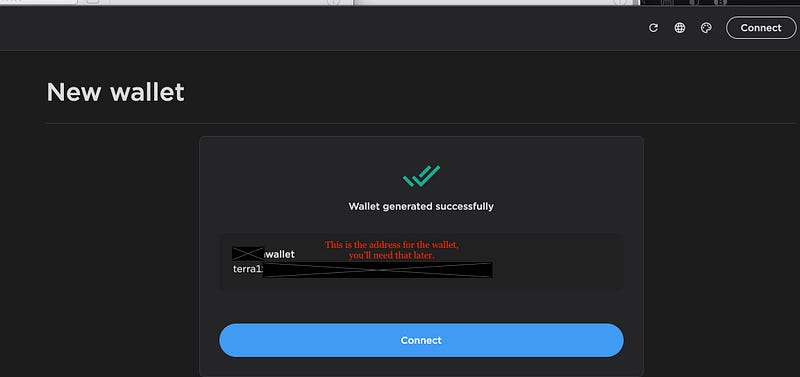

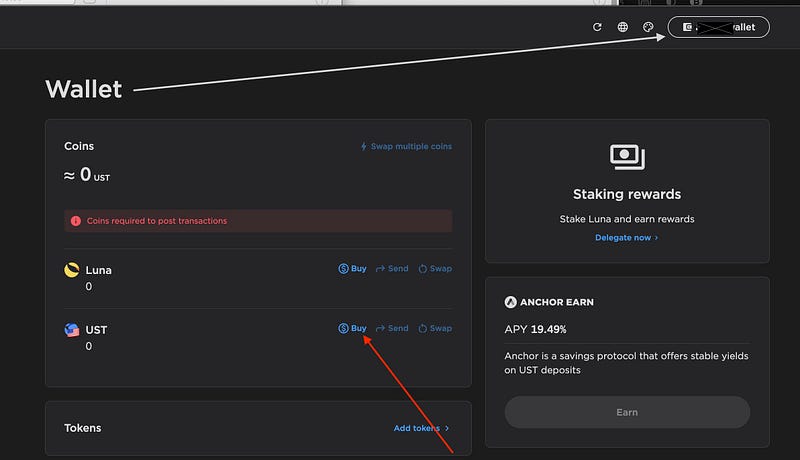

After creating your wallet, connect it; note that it will initially be empty until you purchase crypto.

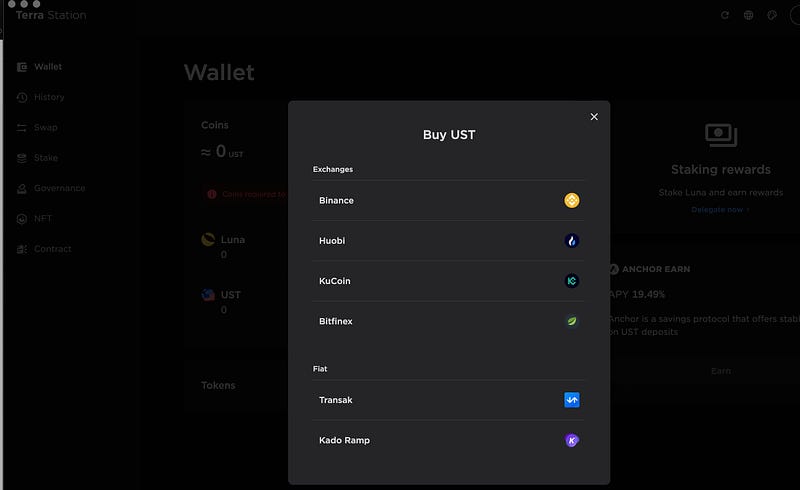

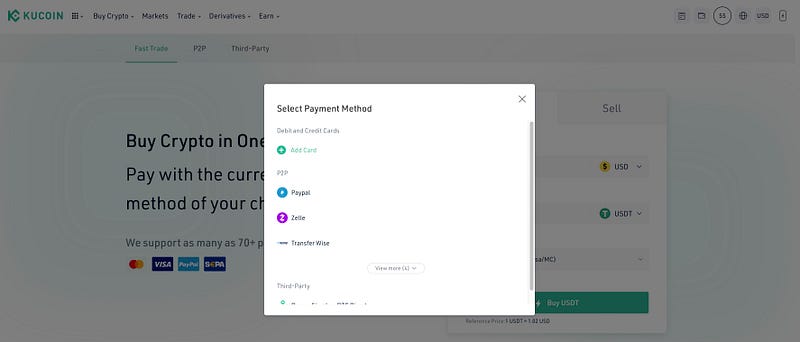

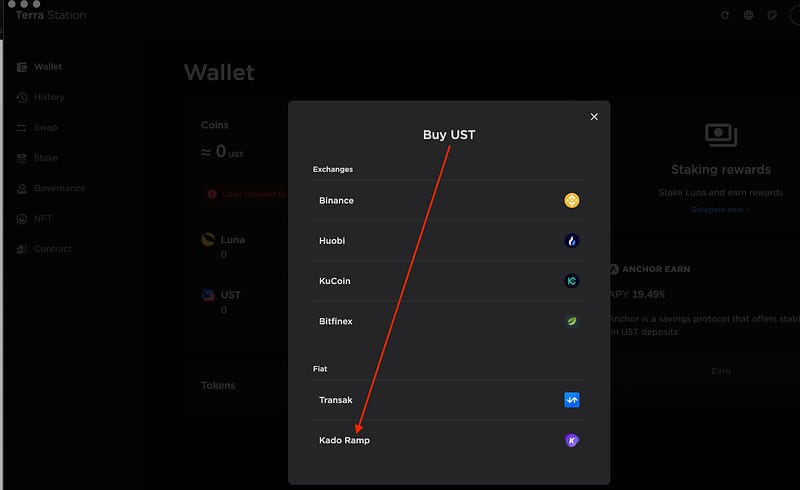

Now, go back to the Dashboard, select “Coins / UST,” and choose “Buy.” A pop-up will display various exchange options for purchasing UST.

Upon selecting an exchange, you will be redirected to that platform. Initially, I tried Binance; however, it doesn't allow UST purchases for users in the US.

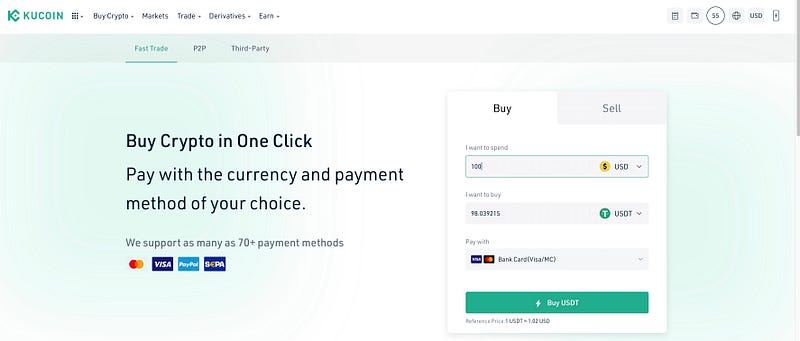

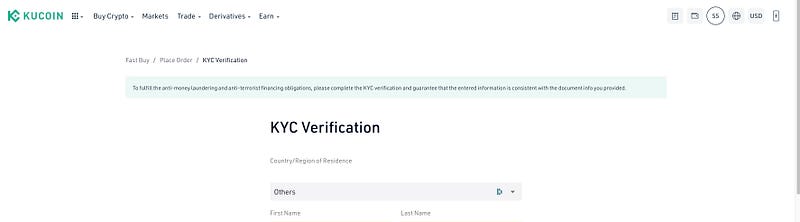

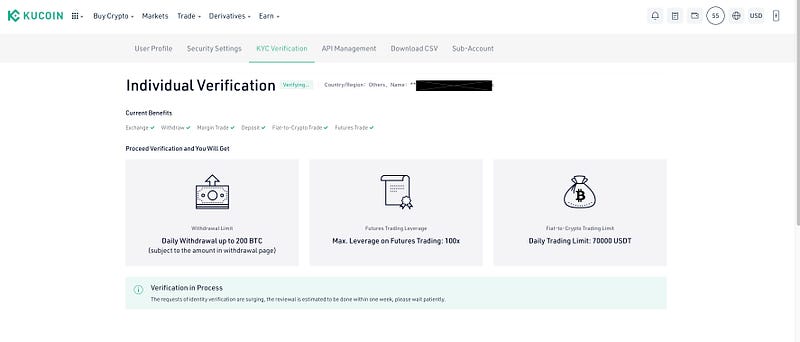

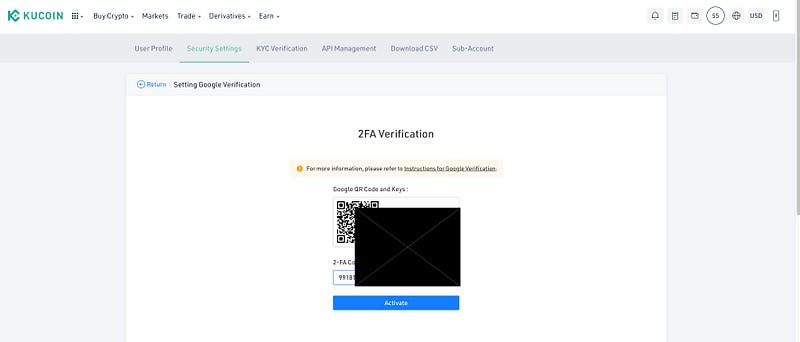

Next, I turned to KuCoin, which permitted the transaction but required extensive KYC verification, including identity verification through document uploads and a handwritten note.

Ultimately, I switched to Kado Ramp, which was simpler and quicker, requiring just my driver’s license for verification and allowing me to get verified in minutes.

Buying UST on Kado Ramp was straightforward. After selecting “Get Started,” I was directed to a page showcasing three products offered by Kado: Ramp, Pay, and Save. Note that the Save module is not where you stake UST using the Anchor Protocol.

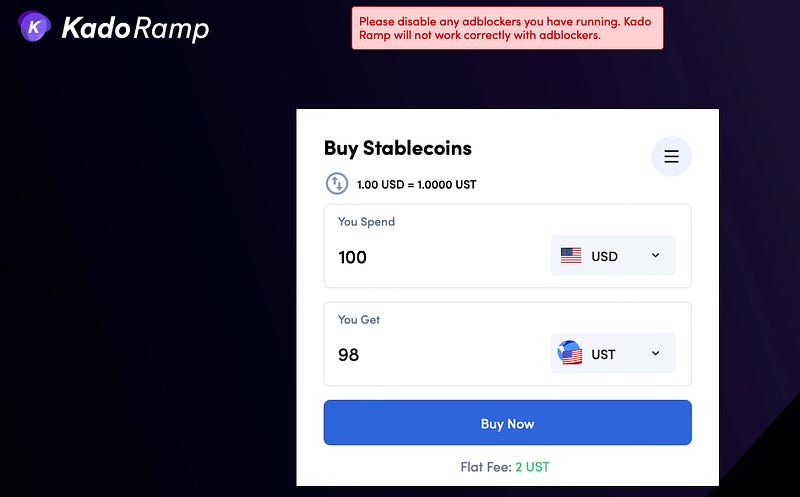

When clicking “Ramp Now,” I was taken to a page where I could purchase stablecoins. I still needed to set up an account on Kado. Here, I could specify the amount of UST I wanted to buy.

After clicking “Buy Now,” I was prompted to enter my wallet address created on Terra. The fee for the transaction was 2 UST, which is essentially $2 or 2%.

Once I confirmed the purchase, I received a notification about my successful acquisition of UST stablecoin on Kado Ramp.

Chapter 2: Staking Your UST

Now that I had bought UST on Kado Ramp, I returned to my Terra Wallet, where the UST appeared seamlessly as I had linked it during the purchase process.

From here, I selected “Earn” to transfer my UST into the “Anchor Earn” feature, incurring a fee of 0.1324 UST, or approximately $0.13.

The following snapshot confirms my deposit into the Anchor Market, showing a total deposit of 97.8676 UST after fees were deducted.

I then revisited my Terra Dashboard to see the crypto I had deposited into the Earn section.

Below is the transaction history for your reference.

Recap: Steps to Stake UST Stablecoin

To stake UST, follow these simple steps:

- Create an account and wallet on Terra Station, the platform that facilitates staking and earning on UST.

- Choose an exchange to purchase UST stablecoins and connect your Terra Station wallet during the transaction.

- After the purchase, return to your Terra Station wallet and deposit your UST into the Earn feature.

You can complete all these actions in a matter of hours or even less. Your main hurdle may be building trust in the process.

I hope this guide assists you in understanding the steps and the trust necessary to become a staker in stablecoins.

Section 2.1: Fees and Performance Insights

My transaction incurred three main fees:

- A network fee of 2 UST on Kado Ramp for the purchase.

- A transfer fee of 0.143718 UST to move my Kado purchase to my Terra wallet.

- A staking fee of 0.1324 UST on Terra for the deposit into Anchor.

In total, from my $100 investment, 97.8676 UST was allocated to earn interest, with total fees amounting to 2.28 UST, roughly $2.28.

Nine days after staking, I checked the performance of my investment.

First, I accessed my Terra Wallet, which showed my staked 98 UST.

To view the actual status of my staked UST, I had to log into Anchor.

Connecting my Terra Wallet to the Anchor Dashboard revealed that I had 98.363 UST.

From my initial stake of 97.8676 UST, I earned 0.494 UST in nine days, yielding an increase of 0.505%. If this trend continues, it could lead to an annual yield of approximately 20.47%. The results seem to validate the high yield interest claims associated with staking UST, though its sustainability remains to be seen.

Section 2.2: Key Terminology

- Staking: Allowing others to use your cryptocurrency, pooled for their financial objectives, in exchange for interest.

- Stablecoin: A cryptocurrency designed to maintain a stable value, unlike more volatile options like Bitcoin or Ether.

- UST: A specific stablecoin linked to the US dollar value, making it less volatile.

- Fiat: A currency supported by a tangible asset or a governmental promise, like the US dollar.

- Wallet: A secure digital location for storing your cryptocurrency, allowing transactions across various platforms.

- KYC: Know Your Customer regulations designed to ensure transaction integrity and prevent money laundering.

- Anchor Protocol: A decentralized platform for cryptocurrency savings, enabling users to earn interest on deposits.

- Kado Ramp: An exchange for purchasing UST and other stablecoins.

- Terra Station: A desktop application for interacting with the Terra blockchain.

Chapter 3: Lessons Learned

Throughout this staking journey, I discovered numerous insights:

- My Coinbase wallet was incompatible for this transaction; UST purchases require a wallet that supports the Anchor protocol.

- I had to disable certain security features temporarily, such as ad blockers and VPNs, to access exchanges.

- Once you stake your UST, it is no longer accessible in your wallet until you withdraw it, which stops the earning process.

Hopefully, this guide has provided you with the necessary information to confidently stake UST.

In this video, you will learn how to earn fixed interest (20%) on UST stablecoin using the Anchor Protocol.

This video offers insights into the bull market throwback and details how to earn fixed interest (20%) on UST with Anchor Protocol.