Understanding the Dynamics of Stock Market Bubbles

Written on

Chapter 1: The Nature of Stock Market Bubbles

Market bubbles are recurring phenomena, often characterized by irrational exuberance and a detachment from fundamental values. As Warren Buffett famously noted, "Be fearful when others are greedy. Be greedy when others are fearful." Despite global challenges like trade wars and health crises, retail investors have been enthusiastically pouring money into the stock market. If you suspect that stock prices are inflated, you're not alone; many economists suggest we're witnessing a significant liquidity bubble created by the Federal Reserve.

While it's impossible to pinpoint the exact moment a bubble will burst, history shows us that bubbles can persist far longer than expected. By examining past market bubbles, we can identify three common indicators: 1. A surge of inexperienced investors entering the market. 2. Widespread market optimism. 3. A prevailing belief that a market crash is unlikely.

In this article, we will delve deeper into these elements, highlighting how current trends mirror past bubbles.

Section 1.1: The Rise of Inexperienced Investors

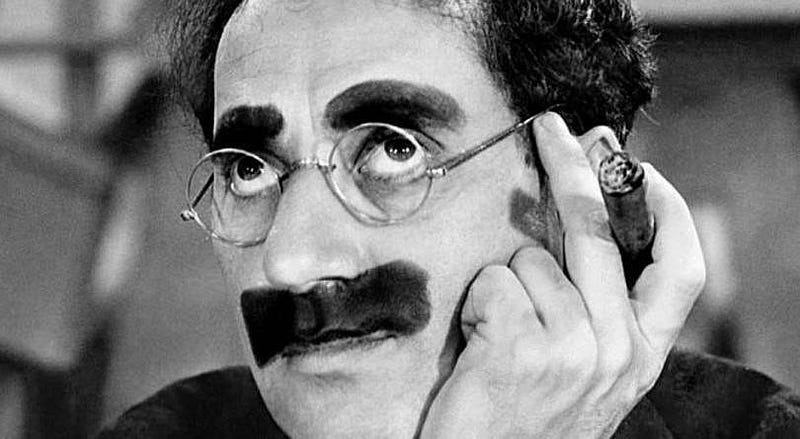

In the 1920s, Groucho Marx, a prominent comedy figure, amassed considerable wealth through stock investments. His experience was typical of the era—many new investors were drawn to the stock market's allure, often overlooking the risks involved.

Every day, Groucho would check the stock board and see his investments climbing, leading him to believe that making money was effortless. However, this perception was shattered when the stock market crashed in 1929, causing him to lose a significant portion of his wealth.

This phenomenon, now understood as the Dunning-Kruger Effect, highlights how a lack of knowledge can lead to overconfidence. Today, many novice investors are diving into the market without understanding the potential pitfalls, reminiscent of Groucho's experience.

Subsection 1.1.1: The Current Landscape of Investing

With the rise of trading tutorials on platforms like YouTube and the popularity of options trading, many are abandoning traditional jobs to pursue trading full-time. This shift towards riskier investments indicates a potential nearing of the current market bubble's end.

Section 1.2: Cognitive Dissonance in Investing

In the 1970s, high interest rates made fixed-income investments appealing, but as rates fell, investors sought higher returns in the stock market. The 1990s saw a rush toward mutual funds as investors became increasingly focused on high-risk opportunities, particularly in technology.

This trend appears to be repeating itself, driven by ultra-low interest rates and the influx of new investors due to the pandemic. Similar to the past, we find too much capital chasing too few stocks, creating inflated valuations.

Cognitive dissonance arises when investors ignore the evident risks and continue to believe in perpetual market growth, often repeating the mantra, "this time it's different." This mindset can blind them to the reality of market bubbles, making it crucial for investors to align their beliefs with real-world fundamentals.

Chapter 2: Historical Patterns and Current Risks

The first video titled "Are We In A Stock Market Bubble?" analyzes the characteristics of current market conditions, providing insights into the risks that investors face.

As the market remains buoyant, many analysts dismiss concerns about overvaluation, arguing that economic conditions have changed. This collective belief is reflected in sentiment indicators, suggesting an impending market correction.

The second video, "Is The Stock Market Bubble Finally Popping?" discusses warning signs that could indicate the end of the current bubble, emphasizing the importance of cautious investing.

Final Thoughts on Market Dynamics

Like previous bubbles, the current market may deflate gradually, marked by short-term corrections followed by temporary recoveries. Investors who have become accustomed to a rising market may find themselves unprepared for sudden downturns.

As history suggests, the timing of central banks' interventions can significantly impact market stability. A careful review of investment portfolios may be prudent at this juncture to mitigate potential losses.

Investors should remain vigilant and consider seeking professional advice before making any significant financial decisions.