Understanding Stablecoins: The Terra/Luna Collapse Explained

Written on

Chapter 1: The Terra/Luna Crisis

The Terra and Anchor protocols have faced significant challenges since May 7, with the fallout from the Terra crash resonating across the cryptocurrency landscape and impacting financial stability for many. This turmoil has also provided ammunition for critics of the crypto sector and traditional finance investors. The fundamental question arises: if the system is disrupted, who can ensure consistent returns and maintain decision-making authority?

In recent days, I've encountered a myriad of opinions regarding this situation. Views range from claims that algorithmic stablecoins are fundamentally flawed scams due to their lack of collateral, to accusations labeling the Anchor protocol a Ponzi scheme, to personal attacks on Do Kwon, who has been branded a notorious scammer. To untangle this mess, we must first grasp how the Terra/Luna protocol operates, its connection to Anchor, and then scrutinize the facts.

Let's delve into it!

Section 1.1: Terra/Luna Explained

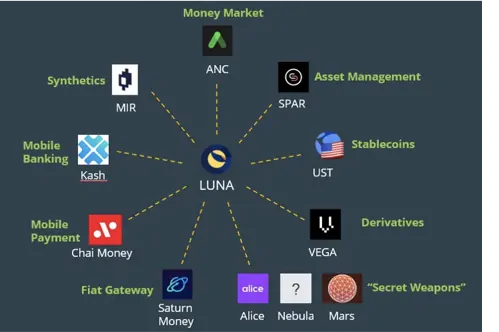

The Terra/Luna ecosystem is an algorithmic, dual-token seigniorage stablecoin designed to maintain the value of its stablecoins. The two tokens are:

- Terra Stablecoins (like UST, KRT, EUT, etc.): Each of these is pegged to a different fiat currency.

- Luna: This serves as the native token on the Terra blockchain, primarily used for transaction fees.

The operation is straightforward: UST tokens can be minted in exchange for LUNA tokens (e.g., EUTs). Conversely, burning UST tokens allows for the minting of LUNA tokens. The peg stability is achieved through arbitrage mechanisms. If UST’s value drops below $1, holders can burn their UST for LUNA at the market price, generating profit. Conversely, when UST exceeds $1, they can convert LUNA back into UST for profit.

This mechanism relies on the market value of LUNA, rather than a fixed protocol value.

As discussed in previous articles, the failed Basis protocol highlighted the vulnerabilities in similar systems. However, it seemed that Terra/Luna had struck the right balance, particularly with staking options provided by the Anchor protocol, which boasted an attractive annual percentage yield (APY) of about 20%. Additionally, the Mirror protocol allowed for the tokenization of real-world assets.

To further bolster the system, Do Kwon, the founder and CEO of Terraform Labs, established reserves via the Luna Foundation Guard (LFG). This foundation aimed to protect the UST peg and initially held approximately $2.3 billion in Bitcoin, with aspirations to reach $10 billion. With such collateral, one would assume the protocol was secure. But how did everything unravel so rapidly?

Section 1.2: The Downward Spiral

On May 7, a staggering $2 billion in UST was withdrawn from the Anchor Protocol, leading to immediate selling pressure. This action caused UST’s peg to dive to $0.91, prompting traders to seize the opportunity to trade UST for Luna at a perceived discount, expecting quick profits. However, they failed to consider the algorithmic limitations, which allowed only $100 million in UST to be burned daily to mint LUNA, triggering a destructive feedback loop that ultimately led to the demise of the Terra/Luna ecosystem.

The following graph illustrates this chaotic situation.

The UST peg was generally stable until the onset of this crisis. Observing market volumes, intervention occurred briefly in late February and early March, but thereafter, the situation appeared stable until May 6.

Examining BTC/USDT movements reveals a similar pattern.

As we transition from May 6, the UST/USD chart indicates the start of the crisis.

The volume spikes around May 5 suggest the onset of a "death spiral" that culminated in a blockchain suspension on May 12, exacerbated by a panic-selling wave.

Looking at BTC/USD, we notice a similar pattern of decline on May 5, followed by a dramatic increase in trading volume leading up to May 12.

Were these events merely coincidental? Perhaps. The collapse of a leading stablecoin can indeed trigger widespread panic across the crypto market.

However, it’s crucial to consider the rumors surrounding major players like BlackRock, Citadel, and Gemini. Allegations suggest that BlackRock, in collaboration with Citadel, borrowed 100,000 BTC from Gemini (valued at approximately $3.9 billion), intending to utilize 25% of it to acquire UST at a discount before returning it to the market, while selling the remainder. This could explain the extraordinary volume spikes that coincided with the UST crisis.

Additionally, it is noteworthy that BlackRock has recently invested in Circle Internet Financial Ltd., the issuer of another dollar-pegged stablecoin, which is now the fourth largest in terms of market capitalization, nearing $50 billion. Did they aim to eliminate a competitor with a substantial volume in the Anchor protocol? The answer remains unclear, as all parties involved have denied any wrongdoing, yet no one has disclosed their transaction records.

Conclusions

In conclusion, algorithmic stablecoins should be approached with caution. Despite robust protocols, they remain vulnerable to human cunning and market dynamics. It is advisable to favor stablecoins backed by tangible assets, as their issuance is tied to fiat supply, making depegging highly improbable.

These reflections are solely my own and do not represent the views of any larger entities, yet the implications of this crisis are undeniably profound.

New to trading? Consider exploring crypto trading bots or copy trading options!