generate a compelling title that emphasizes the financial impact of quitting smoking

Written on

Understanding the Impact of Smoking on Health and Finances

Smoking cigarettes can lead to a staggering financial cost over time, potentially exceeding $1 million. It is essential to note that smoking poses serious health risks, including cancer and other life-threatening conditions. This article does not advocate for smoking; rather, it discusses the economic harm associated with it.

This piece serves as an additional motivation for individuals to consider quitting smoking. Imagine a scenario where an individual stops smoking, saves the money previously spent on cigarettes, and invests those funds wisely.

The average price of a pack of 20 cigarettes stands at approximately $40, which breaks down to about $2 per cigarette. For the sake of this analysis, let’s assume a smoker consumes an average of three cigarettes daily.

- Daily expenditure on cigarettes: $2 * 3 = $6

- Weekly expenditure: $6 * 7 = $42

- Monthly expenditure: $6 * 30 = $180

- Annual expenditure: $6 * 365 = $2,190

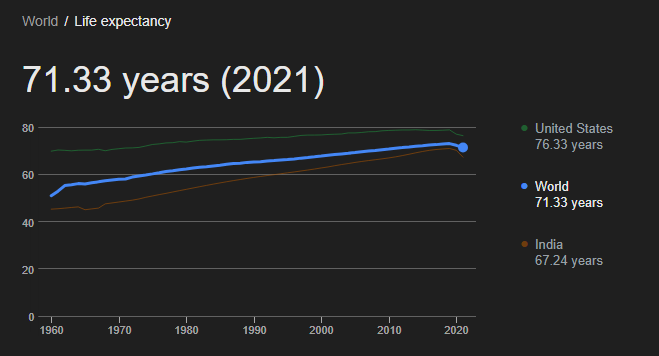

If we consider that most people begin smoking at around 16 years old and have an optimistic life expectancy of 72 years, we can estimate the financial toll of smoking over a lifetime.

Calculating the number of years spent smoking:

72 (life expectancy) - 16 (age started) = 56 years of smoking.

Now, let’s calculate the total cost of cigarettes over a lifetime:

56 years * $2,190 = $122,640 (not accounting for inflation).

Assuming retirement occurs at age 60, we can evaluate the potential investment of $180 per month into various retirement funds.

Mark Twain once said, "Quitting cigarettes is easy; I’ve done it a thousand times." Please note this is not investment advice.

Index Funds

Assuming an average annual return of 10%:

- Monthly investment: $180

- Investment period: 44 years

- Total wealth accumulated: $1,720,169.21

- Total investment: $95,040.00

- Total gains: $1,625,129.21

Achieving over $1 million in just 40 years is possible without any special saving strategy.

Gold

With an average return rate of about 8%:

- Monthly investment: $180

- Investment period: 44 years

- Total wealth accumulated: $880,416.56

- Total investment: $95,040.00

- Total gains: $785,376.56

Reaching $1 million through gold investments would take around 47 years.

Bonds

With an average return rate of 4.5%:

- Monthly investment: $180

- Investment period: 44 years

- Total wealth accumulated: $299,485.48

- Total investment: $95,040.00

- Total gains: $204,445.48

Achieving $1 million in bonds would take approximately 70 years.

Conclusion

By quitting smoking, individuals can simultaneously build their retirement funds and improve their health. The financial implications of smoking are significant, and making the choice to stop can lead to a more prosperous future.

Add your thoughts in the comments section below.

The first video title is "How do cigarettes affect the body? - Krishna Sudhir - YouTube," which delves into the physiological impacts of smoking.

The second video title is "Why smokers end up paying higher life insurance premiums than non-smokers | World No Tobacco Day - YouTube," which explains the financial repercussions smokers face regarding insurance.