Maximizing Profits with the Simple Options Day Trade Strategy

Written on

Chapter 1: Understanding the Simple Options Strategy

The notion that trading options is a "fool's game" is commonly heard, especially concerning day trading. However, it's essential to clarify right from the start that this perspective is misguided.

The Simple Options Trading Approach

The trades executed under this straightforward day-trading approach focus on taking positions on both the call and put options. I once shared this method with an acquaintance, suggesting that he could achieve a 100% return through day trading options, though I suspect he remains skeptical.

The signal for entering a trade is incredibly simple. If call options are trading above their opening price, it's time to buy the calls. Conversely, if put options surpass their opening price, it's advisable to purchase the puts. That's all there is to it, but remember to implement a stop-loss to mitigate potential losses.

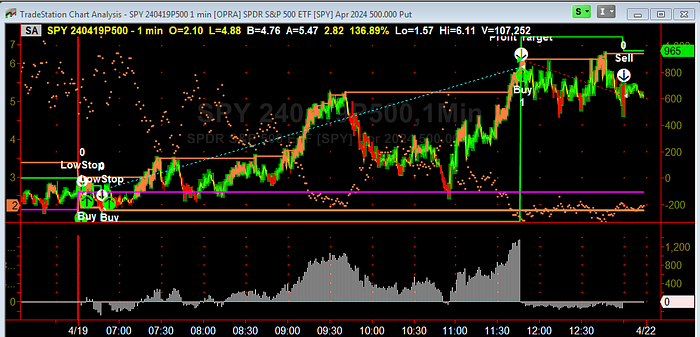

On April 19, 2024—After Market Close…

I find myself increasingly frustrated by the need to reiterate this fundamental truth. With dedication, experience, and discipline, the Simple Options Strategy consistently proves effective.

Given the considerable downturn in the overall market, it was only natural that SPY and QQQ would be trending toward puts for day trading. Nevertheless, it's prudent to explore other opportunities post-open, leading to significant movements in META and NVDA.

Below, you'll find the relevant charts.

P.S. As a side note, I suspect the market might experience a rebound in the upcoming week. Last Monday, 40 stocks were listed in my Nifty50StockList, but by Friday, that number dwindled to 32—a potential indicator of a market reversal despite the major indexes facing declines. Additionally, SPY has experienced a six-day downturn, which is relatively uncommon.

While the NYSI has dropped for 14 consecutive days, the NYMO has shown an upward trend for three days. While I wouldn't characterize this as a definitive market bottom, I believe we might witness a rebound early this week.

Chapter 2: Market Insights and Predictions

In the video titled "Friday Twin 25s | World 100 at Eldora Speedway 9/6/24 | Highlights," viewers can catch exciting highlights from the event, showcasing thrilling moments and key performances.

The live broadcast titled "LIVE: World 100 Friday Prelims at Eldora Speedway" provides real-time coverage of the preliminary events, offering insights and behind-the-scenes looks at the competition.