Exploring Web3 Savings Accounts with Stablecoins

Written on

Chapter 1: Understanding Stablecoins

In the quest to navigate the world of web3 savings accounts through stablecoins, I've recently established a 'savings account' on Maker using DAI. With the recent challenges faced by algorithmic stablecoins, it seems prudent to look into stablecoins that are secured by tangible assets.

It’s important to note that stablecoins can be categorized into two main types:

- Stablecoins backed 1:1 by physical assets: Examples include USDC, PAX, and GUSD. These can be viewed as tokenized IOUs that are anchored to the US dollar.

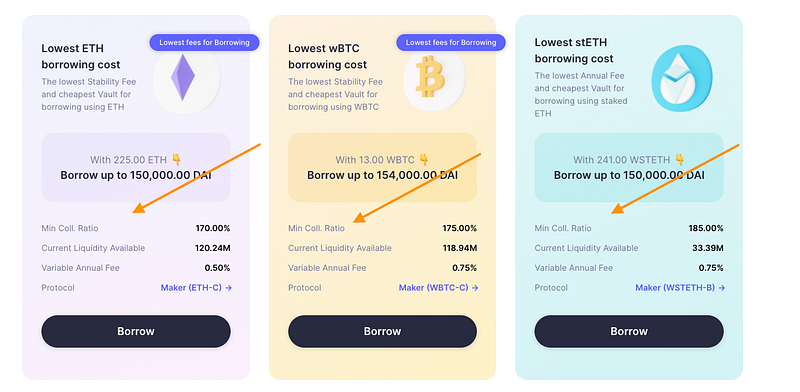

- Stablecoins secured by cryptocurrency collateral: Often referred to as 'bankless' stablecoins, these lack FDIC insurance. Investors earn yield by over-collateralizing their assets, such as ETH or BTC, in exchange for returns. DAI stands out as a leader in this sector.

Investors aiming for yield typically need to maintain a minimum collateralization ratio of over 175%, with a minimum staking amount around 5,000 DAI.

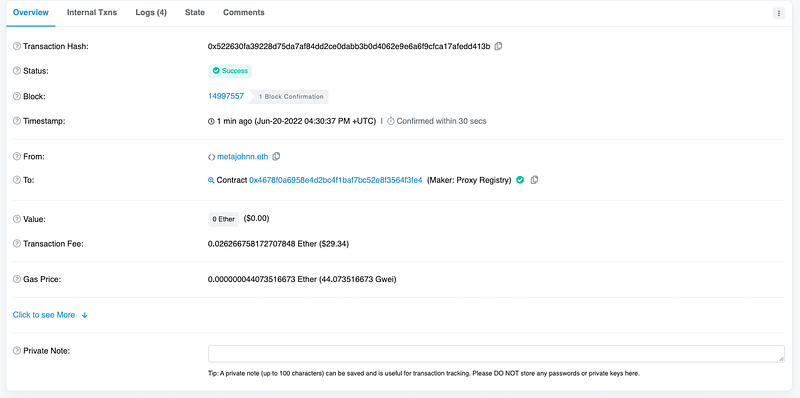

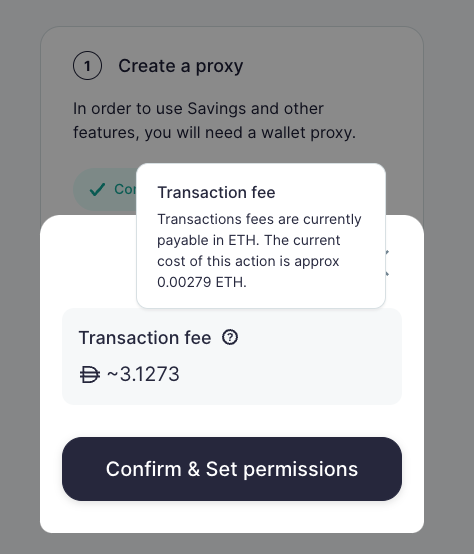

Now, let’s get started on creating a savings account through Oasis. The first step involves setting up a proxy, which serves as a smart contract to manage your DAI or collateralized debt positions (CDP). This proxy consolidates multiple transactions into a single action, and the associated gas fees for its creation are approximately 0.02 ETH at this time.

Every transaction incurs a gas fee, so in addition to setting up the proxy, there are fees related to defining permissions:

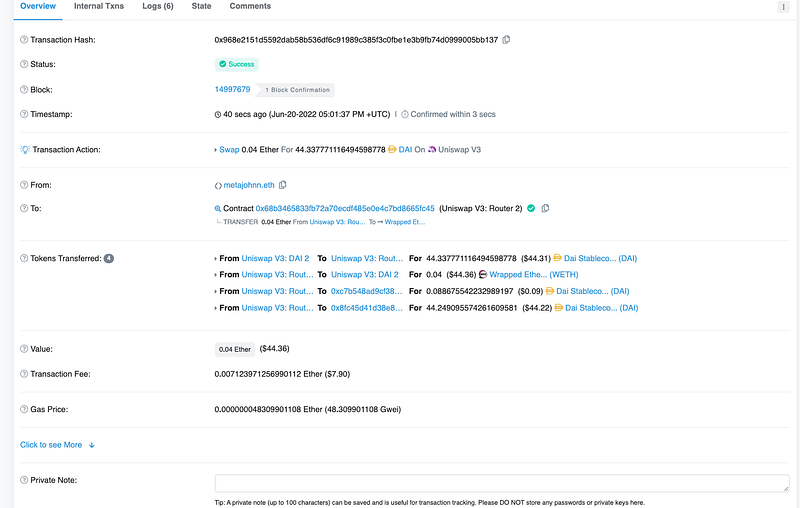

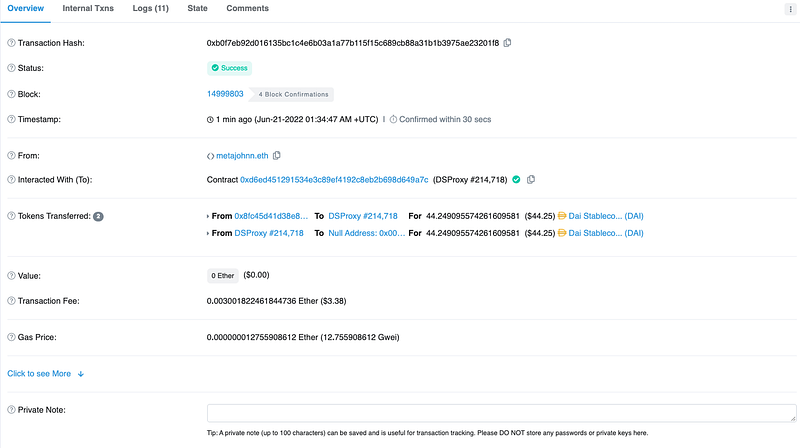

For this process, it's essential to have DAI in your wallet. While you can acquire DAI through Uniswap, Oasis offers a built-in feature that allows you to remain on the platform. I exchanged around $50 of ETH for $50 of DAI, with $8 in gas fees.

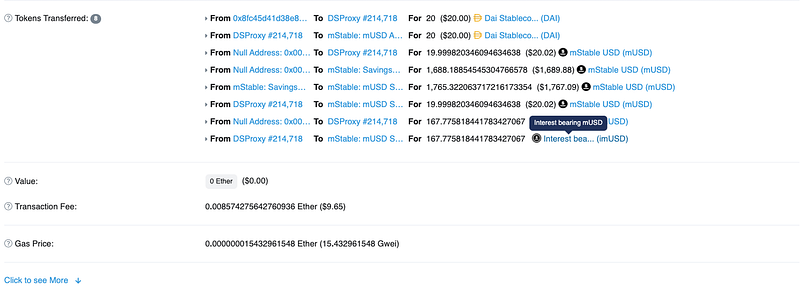

After depositing the DAI into the proxy (and covering the gas fees), you can view the deposit transaction of DAI via the DSProxy.

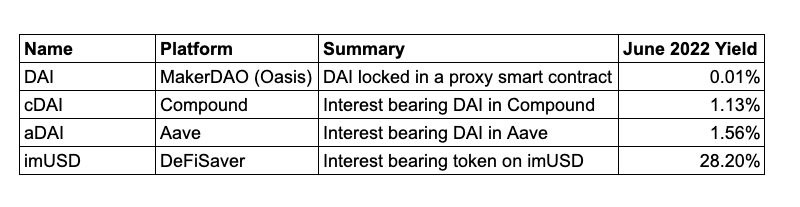

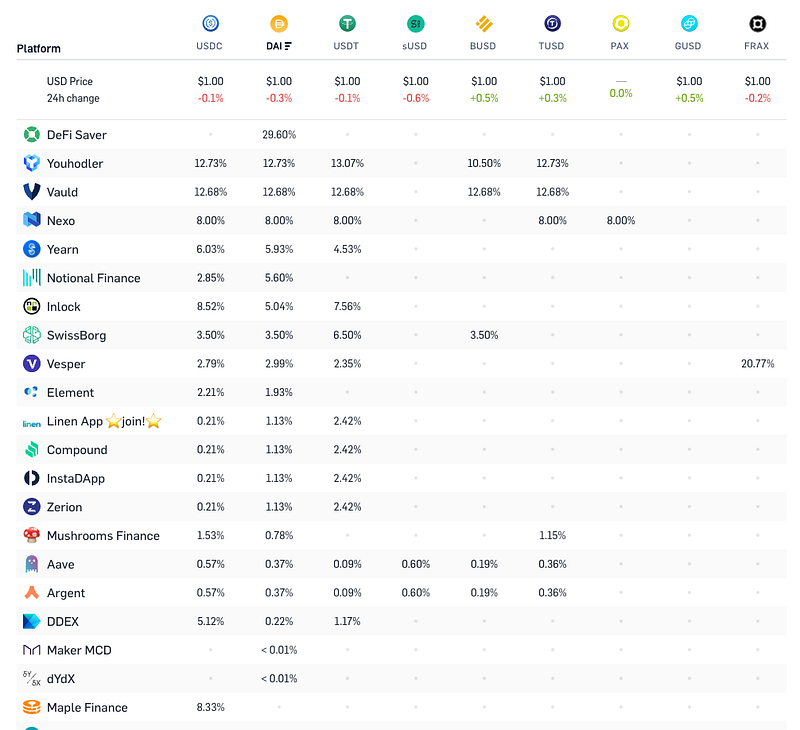

At present, depositing DAI into Oasis yields only 0.01% APY, which is relatively low. Higher yields can be found on other platforms; however, one must be cautious, as centralized exchanges can be opaque and rely on trust.

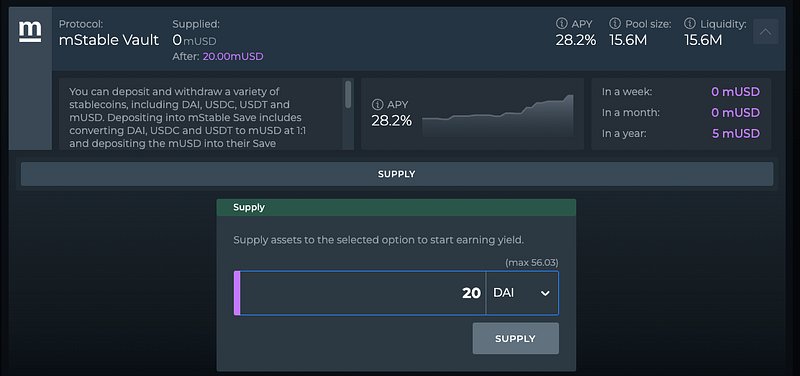

Currently, I’m taking a risk with DeFi Saver to chase a promising yield of 28.2%. This indicates that a $20 deposit could potentially grow to $39.99 over a year. Time will tell if this strategy pays off.

In return for my investment, I received an intriguing mUSD token.

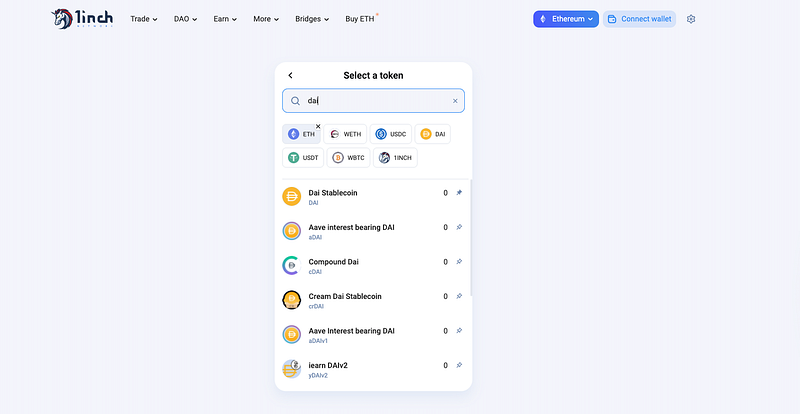

There are numerous ways to engage with the yields provided by DAI. One option, as mentioned earlier, is to use Oasis to create a proxy and add your DAI to its vault for a 0.01% yield. Alternatively, platforms like DeFi Saver can be utilized, or you can purchase the DAI token of your choice through aggregators like 1inch.

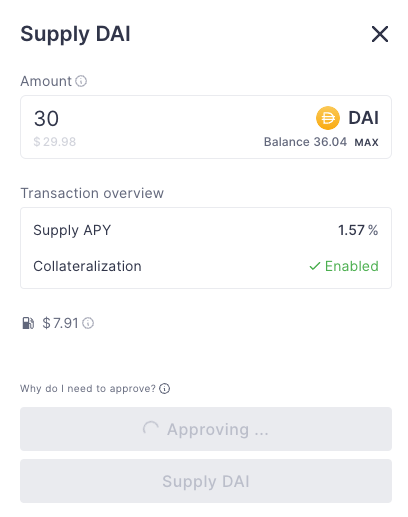

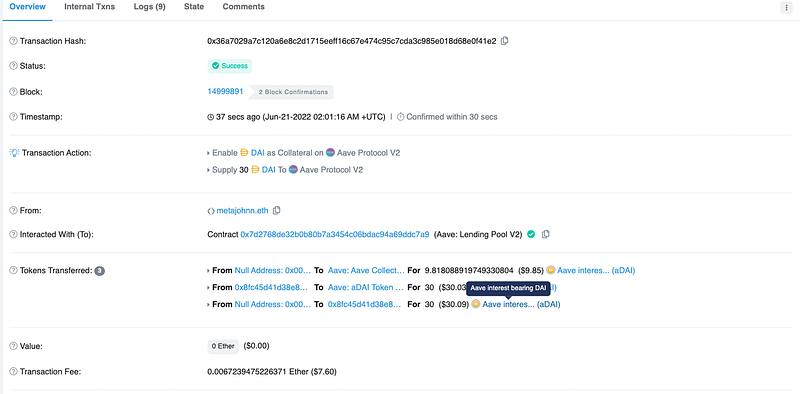

Lastly, I plan to supply DAI to Aave, which currently offers an annual yield of 1.57%.

In exchange, I will receive aDAI, an interest-bearing token.

Below is a summary of the DAI tokens we've discussed along with their respective APY; this list does not include CHAI, yDAI, iDAI, etc.